Finance

-

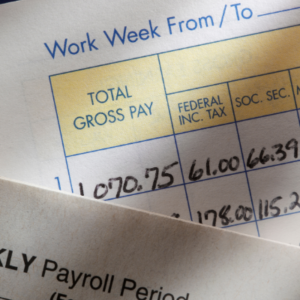

Hidden Payroll Errors that Trigger IRS Audits

View Workshop -

Payroll Record Retention Requirements: What to Keep, What to Ditch

View Workshop -

EEO-1 Reporting: What’s Required and When It’s Due

View Workshop -

Calculating New Regular Rate of Pay: Compliance Updates for Employers

View Workshop -

Sales & Use Tax Update: Requirements on Out-of-State Taxes

View Workshop -

Payroll Tax Compliance Roadmap for 2020

View Workshop -

Keep Your Year-end Payroll on Track and IRS Compliant

View Workshop -

Demystifying Worker Classification: New Rules and Insider Insights from a Former California Internal Auditor

View Workshop -

Supplemental Pay Taxation: Essentials for Payroll

View Workshop -

Responding to B-Notices & TIN Verification: Avoiding Costly Mistakes

View Workshop -

Fringe Benefits Taxation & Reporting Rules & Guidelines

View Workshop -

Third Party Sick Pay: How to Tax & Report

View Workshop